The world of electronic payments is dominated by PayPal. Do you know what is PayPal? How does PayPal work?

PayPal is a payment platform with a website and a phone app that enables payments between parties through online money transfers.

Since its inception decades ago, PayPal has remained a popular option for online payments and shopping. To start using PayPal, you must be aware of the following.

What is PayPal and How Does It Work?

PayPal is an online payment system that makes paying for things online and sending and receiving money safe and secure.

When you link your bank account, credit card or debit card to your PayPal account, you can use PayPal to make online purchases from participating merchants. Your payment information is kept secure by PayPal, which acts as a go-between for your bank and retailers.

PayPal allows you to send and receive money safely from others as well as to send money to friends and family.

This feature is helpful for situations like sharing rent with roommates or getting cash for your birthday.

You Might Also Like: Does Shein Take PayPal?

Why Use PayPal?

Secure Transactions

Merchants may occasionally have access to your payment information when you use your debit or credit card to make online purchases.

By ensuring that merchants never see your sensitive information, PayPal adds an extra layer of security.

Along with other security measures, PayPal uses email confirmations for transactions, end-to-end data encryption, and optional two-factor account logins to keep user accounts safe.

Easy and Convenient

PayPal is now the fifth most accepted payment option after The following credit cards are accepted worldwide: Visa, Mastercard, American Express, and Discover.

Have you ever wanted to purchase something online but were unable to do so because you didn’t have your credit card on hand? You don’t need to type in your card numbers again when using PayPal to make a payment using cards that are linked to your account.

Remembering (or saving) your PayPal login details is all you need to do in order to make a purchase through PayPal.

Who Uses PayPal?

PayPal has over 200 million users globally, with 29 million merchant accounts. It has been around for a while and has now become the preferred digital payment method for eBay.

After years of operation, nearly every kind of business and consumer now uses PayPal. Unlike a bank account, there is little barrier to entry, so anyone can sign up and use the service right away.

How Set Up PayPal? 4 Simple Steps

Signing up for PayPal and getting started is not a huge feat. Actually, it’s quite easy; all you need to do is have the necessary data ready.

The quickest ways to get started in the world of digital payments are outlined below.

Step 1: Create a Free Account

Go to PayPal.com and click the “Sign Up” button in the upper right-hand corner. Choose between a personal and a business account.

Now is also a smart time to get the PayPal app for your mobile devices. People are now able to manage their finances at any time and from any location.

Step 2: Provide Details

When signing up for a PayPal account, make sure you have all your data in order. Be prepared with the following:

- Name

- Date of birth

- Address

- Phone number

- National ID or Passport Number

- Email Address

- Bank account number

- Bank routing number

- Debit and/or credit card data

The creation of a password is another requirement. In order to prevent account hacking or phishing, it must be memorable and contain letters, numbers, and characters.

If you open a personal account and later decide you need to conduct business, you can upgrade it.

After you input all data, be sure to check to box to accept PayPal’s “Terms and Conditions.”

Step 3: Link Your Bank Account

Look for the wallet icon on the top bar to link a bank account. You will then see a summary of your linked credit or debit cards, as well as your current PayPal balance. Click on “Link a Bank Account” to start the process.

The user can then add their bank account information using wire transfer or bank verification. The following are details you may need:

• Bank name

• Bank code

• Branch location

• Branch code

• Bank account number

Always check to see there’s a “secure lock” icon at the top-right edge of the page to ensure you’re in the right place.

A verification code will be sent to the associated phone number after the bank information has been entered. Since opening an account is free, no deposit is ever necessary.

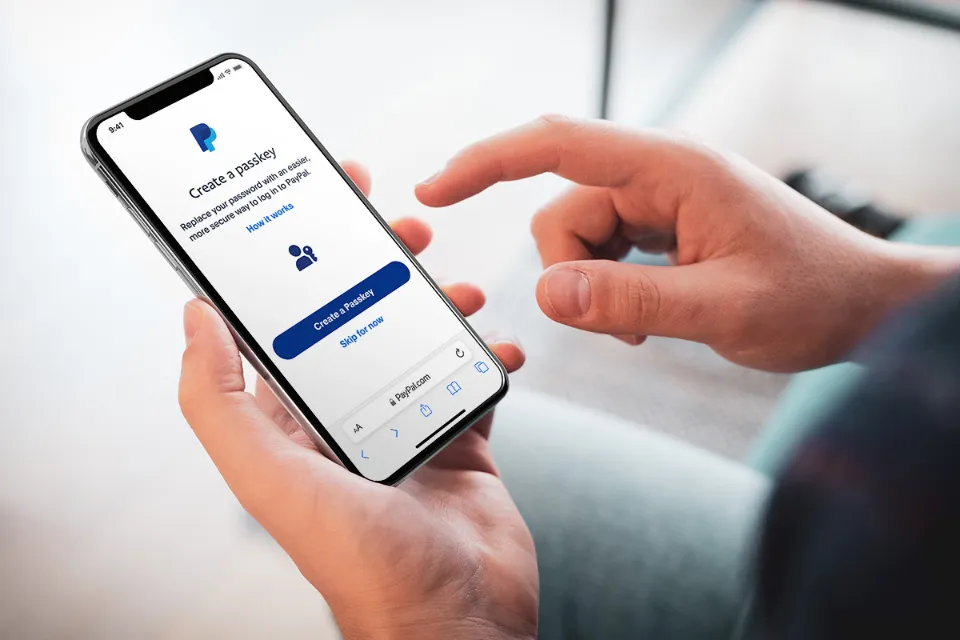

Step 4: Verify All Data

To ensure that you are a legitimate user, certain safeguards are in place. The email address associated with the new account must then be verified.

Check your inbox for the PayPal verification email. Click on “Confirm Email Address” to verify the information on your network. That is all that is required to set up and start using PayPal.

PayPal may also ask you to text a one-time passcode in order to confirm the information if you connect a mobile number. Enter that to verify your cell data and make sure you have the notifications set to “on” to manage transactions in real-time.

Is PayPal Free to Use?

Online purchases and the majority of personal transactions using PayPal are free as well as the process of creating an account. However, there are some transactions for which PayPal does charge a fee.

Fees for Purchases

As long as there is no currency conversion involved, there are no fees associated with making purchases from merchants that accept PayPal online.

If you buy something in a foreign currency, there is a 3 percent or 4 percent foreign transaction fee.

Fees for Personal Transactions

PayPal considers a transaction to be personal when it involves sending or receiving money from friends and family for non-commercial, personal reasons. PayPal has a special “Friends and Family” tab you can click when making personal transactions.

Depending on where you send and receive the funds, some of these transactions are subject to fees and others are not.

There are no fees for domestic personal transactions when you use your PayPal balance, bank account, or Amex Send™ Account, but there is a 5% fee (between $0.99 and $4.99 USD) for international transactions.

If you send money using a debit or credit card, you will be charged 2.9 percent for domestic transactions and 5 percent for international transactions, plus a fixed fee that varies based on your country ($0.30 USD for payments coming from the United States).).

Does PayPal charge a fee for receiving payments? In general, no. As long as there is no currency conversion, receiving money from a friend via PayPal is free.

Fees for Withdrawing Money

When using PayPal, there are additional charges that you might encounter. While there are no fees involved in transferring funds from your PayPal account to a local account, you will have to wait for the transaction to complete.

A 1% fee must be paid if you want immediate access. Additionally, there is a $1.50 per withdrawal charge for using a check to withdraw money from your PayPal account.

Is PayPal Safe to Use?

End-to-end encryption is used by PayPal, and users have the option to turn on two-factor authentication to further secure their transactions.

It is the safest electronic transaction currently available.

Conclusion on What is Paypal

PayPal is a big player in the crowded field of payment apps for use online and off.

Basic functions like money transfers and using your checking account to make purchases are free for users. Other services, like PayPal credit and debit cards and transactions involving currency conversion, have a fee attached. Industry standard applies to the fees.

PayPal charges transaction fees to businesses that use the service. Additionally, they have access to a number of complementary small business services that PayPal provides.

FAQs

How Does Paypal Work When Receiving Money?

Open a PayPal account, verify your email address, and accept the payment.

How Does Paypal Work Without a Bank Account?

You can still use PayPal even if you don’t have a bank account by connecting it to a credit card.

What is the Disadvantage of Using PayPal?

Sending money to friends and family via PayPal is cost-free, but business transactions will incur fees. While a free bank transfer takes a few days, PayPal also levies a 1% fee if you want instant access to your money.